Best practices in Promoting Digital Payments

Best practices in Promoting Digital Payments

Introduction

The Digital India programme is a flagship programme of Government of India with a vision to transform India into a digitally empowered society and a digital economy. Under this programme, Government targets to promote digital payments and support development of low cost and easy to use digital payment solutions for all sections of the society.

As part of ‘Paperless, Cashless and Faceless’ services across the country especially in rural and remote areas, various modes of digital payments are being provided like Banking Cards, Mobile Wallets, Internet Banking, Mobile Banking, Bank Pre-paid Cards, Micro ATMs, Point of Sale machines (PoS), Aadhaar Enabled Payment System (AEPS) and Unstructured Supplementary Service Data (USSD).

The focus areas with regard to promoting digital payments, are as follows:

- Seeding of Bank Accounts with Aadhaar and mobile numbers.

- Enabling Public Financial Management System (PFMS) facility in the Panchayats of the Districts.

- Adopting digital payment facilities at ration shops and fertiliser shops to enable digital payments.

- Enabling digital payment facilities at Revenue (Tehsil) offices.

- Increasing revenue collection from electricity bill payment through digital modes.

- Ensuring transparency/accountability in promoting digital payments and implementing digital infrastructure.

- Developing digital payment ecosystem comprehensively.

Best Practices for Replication

Primarily, objective of promoting digital payments is to create awareness about digital payments among people and make them aware about the advantages of digital payments to convert India into less-cash society.

- Administration is coordinating with banks, NGOs, government officials and public representatives to spread awareness about digital payments by organising different programs, camps, rallies, gram sabhas, Digi Melas, Garib Kalyan Melas, Nukkad Natak, bike rallies, digital marathon etc.

- Door-to-Door campaigns and surveys are being conducted by the help of NGOs, Business Correspondents (BCs), Self-Help Groups (SHGs) to literate and aware people about digital payments, especially in villages and rural areas.

- As information can be disseminated faster and more efficiently through audio video means of training, DigiRath and digital LED vans are being used through designated route maps, such that they cover every village in the district.

- Print media (pamphlets, brochures, slogans, leaflets, booklets, banners and posters), electronic media (TV, radio jingles) and social media (Facebook, Twitter, WhatsApp) are actively being used to create awareness among all societies of people.

- Digital literacy centres are opening and Digi Dhan Melas are being organized at State and District level to educate people about digital payments.

- Digital payments training program for capacity building are being conducted for government functionaries like revenue officials, block level officials, district level officials, teachers, FPS agents, fertiliser agents, etc. so that seamless digital services would be provided to citizens.

- Different trainings are being organised on digital payments based on Training of Trainers (ToT) model where master trainers are being created for further training of people.

- Administration, schools, colleges and universities are imparting knowledge about digital payments to students and using them as master trainers and brand ambassadors to spread knowledge about digital payment amongst people.

- School students are being taught about digital payments in morning assemblies and homework also includes something about digital payments.

- For effective implementation, monthly coordination and monitoring meetings are being conducted at district and block levels where data on digital transactions from government agencies and banks are collected and analysed by the administrator. Based on the feedback, clear cut objectives and plan of actions for every level of administration are being prepared.

- Incentive schemes like install BHIM and get `50 is used to promote digital payments. Fair price shops and fertiliser shops are offering discounts to customers on digital payments. Local festivals are used to promote digital payments by setting up demo stalls where knowledge about digital payment modes are provided.

- To promote digital payments in market areas, awards are given to shopkeepers who are doing well in digital payments. Industries are making payments to their employees digitally. This provides better satisfaction to both employer and employees.

- Administration is providing free Wi-Fi services at prime locations, tourist spots and market areas to promote digital payments. Internet is provided at panchayats through Baratnet so that promoting digital payments in rural areas will not be a challenge.

Suggestions for Effective Implementation

Awareness about using digital solutions like smartphone based transactions and use of credit/debit cards at PoS solutions is still a persistent issue in rural areas. The government, along with Reserve Bank of India (RBI) has implemented and initiated numerous schemes like Pradhan Mantri Jan Dhan Yojana to promote financial inclusion, especially in rural India. Despite all the efforts, some population still doesn‘t have access to banks. To overcome these challenges, more awareness campaign and training camps should be arranged in rural areas to literate people about the benefits of having bank accounts and doing digital payments. Make all banks responsible to form a training team at branch level with bank staff and skilled volunteers to train the local merchants and inform citizens about digital payments and benefits of seeding bank accounts with mobile number and Aadhaar.

All government departments and officials should involve at district, block and tehsil levels to create awareness and promote digital payments. More incentivising schemes should be introduced for both merchants and customers to promote digital payments. Monthly service charges on PoS machines and transaction charges levied by banks on digital payments should be minimised or borne by the district/state/ central government bodies.

Network issues, poor mobile coverage and internet reach is a major challenge in rural areas, thus denying access to digital forms of transactions. Augmentation of digital infrastructure is required, especially in rural areas to provide better internet connectivity with sufficient band width to promote digital payments.

People are bit apprehensive about security concerns related to digital payments such as fraudulent misuse of payment networks and data theft. Hence, to gain confidence of citizens, cyber security protocols need to be strengthened for securing digital payments.

Aadhaar enabled Payment System (AePS) is majorly used in rural areas, and biometric readers are integral part of the Aadhaar based payment system. It is better to ensure that quality biometric readers are available in the market. Tapping of industries where unorganised labour is working and payments to them are happening in cash.

Cash Studies

Cash Study 1 : Bishnupur, Manipur

Implementing Digital Payments Promotion Strategies:

- With an aim to create awareness about Digital Payments Mission, local people were involved along with different civil societies. Door-to-Door campaigns were organised for financial literacy and to educate people about the digital payments.

- Campaigns were undertaken in market areas to promote digital payments among merchants and consumers. Workshops were conducted and competitions were held in schools and colleges.

- The ‘I Pledge’ campaign was launched to contribute to the Government’s vision of creating a cashless, and corruption-free India by spreading the information about digital financial transactions.

- Incentive scheme were provided to promote BHIM (i.e. ‘Install BHIM and get `50). Free PoS machines were provided the merchants who opened current account, and fertiliser dealers.

Implementing specific Digital Payments Promotion Strategies (only for Karang Island):

Karang Island was a remote and backward region, which was relatively cut-off from the District due to insurgency for a long time. In this regard, incentives were provided for training towards digital payments and five PoS machines were provided on the island. Self Help Groups (SHGs) and youth clubs were involved for community mobilisation and parallel activities were conducted on the island for Aadhaar enrolment and bank account opening. Additionally, shop-toshop awareness was also provided, coupled with set up of PoS machines for fertiliser dealers.

Using Technology:

Digital Bishnupur-An online channel was launched to make people literate about digital payments. In addition, social media interventions were made for promoting digital payments.

Impact (01.04.2016 to 31.12.2017)

Karang Island of the District became the first cashless island of the country. Cash outflow per capita from SBI Bishnupur branch reduced by 33% and the district got the second position in painting and slogan writing at state Digi-Dhan Mela 2017. There was enhanced transparency and accountability in Government payments with increase of digital transactions. All 24 Gram Panchayats, six Municipal Councils are enabled with Public Financial Management System (PFMS) facility. About 92% of bank accounts were seeded with mobile and 70% of bank accounts were seeded with Aadhaar. Further, percentage of electricity bills paid through digital payment mode increased from 78% to 97% in last 20 months.

Case Study 2 : Daman and Diu

Implementing Digital Payments Promotion Strategies:

- Digital payment awareness was created by following ‘Train the Trainers’ model in the District. Around 1,000 people from various sectors and groups were provided extensive training.

- Promotions were done for the programme by leveraging banners, hoardings, mass SMS and social media platforms.

- A special meeting was organised for more than 700 industrialists, where they were imparted training on various modes of cashless payments and urged to ensure that their employees and workers also switch to cashless modes of payments.

- 140 teams were formed to undertake door-to-door campaigns, to ensure that at least one person from each household does a digital transaction and intensive training was done for a team of 10 people including one nodal officer, one teacher, six-eight students and one IT person.

- A mega ‘Cashless Daman’ campaign was launched, where the District Administration officials addressed 3,000 people on digital payments. It was made mandatory for industries to make payment only through bank accounts.

- Daman and Diu Electricity Department (DDED) collected electricity bill payment through various cashless modes i.e. Internet Banking, Credit/Debit Cards, PoS Machine at all its collection counters and e-payment facility was also made available to the public.

- In addition, ration distribution at every Fair Price Shops (FPS) in Daman District was made through Aadhaarenabled PoS machines. Digital payment modes and PoS machines were provided at the Fertiliser Shops and Fair Price Shops as well.

Using Technology:

Technology was used in the implementation of the programme by way of social media interventions for promoting digital payment via Facebook and Twitter pages and SMS campaign to create awareness about digital payments. Also, digital payment videos involving students, teachers, small vendors were made and circulated over WhatsApp, Facebook and Twitter. There was real-time data sharing over WhatsApp group.

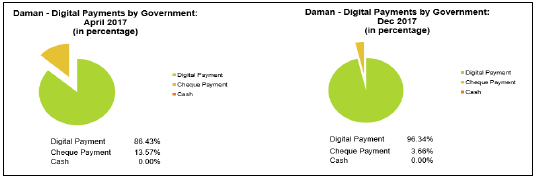

Impact (01.04.2016 to 31.12.2017)

In all, 11 Panchayat funds were disbursed through Public Financial Management System (PFMS) only and cashless fund collection facilities were available at Citizen Services Centres. PoS machines and other digital payment facilities were provided in all 38 Fair Price Shops. All fishermen purchased diesel through cashless methods only. Tehsil Office in Revenue Department has seen 100% cashless transactions in last two months. All industries moved to 100% cashless payment of salaries to workers. In addition, the departments and Offices of Union Territory administration started to accept digital payment transactions. All distilleries, petrol pumps, restaurants and hotels have digital payment facilities. Further, Cashless Citizen Services (i.e. G2C, B2C services) were provided at 37 Common Service Centres (CSCs). Government to Government payments were 100% digital and Government payments to beneficiaries was 100% via Direct Benefit Transfer (DBT) only. All Government receipts above `1,000 were accepted through digital payment only. About 92% of bank accounts were seeded with mobile and 83% of bank accounts were seeded with Aadhaar. The percentage of electricity bills paid through digital payment mode increased from 21% to 46% in last 20 months.

Case Study 3: Sonipat, Haryana

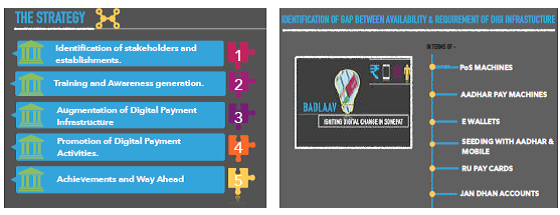

Implementing Digital Payments Promotion Strategies:

- Identification of stakeholders and establishments to identify areas with maximum footfalls. Initial survey were conducted to identify the usage statistics of digital payments.

- Digi Dhan Mela was conducted where 170 stalls were set up and footfall was around 1,50,000 and 112 awards were given.

- Further, 10,00,000 bulk SMS, video messages were broadcasted on cable TV and social media to generate awareness about the programme. 1,100 medium size banners were put up and 1,00,000 handbills were circulated. Additionally, banners were pasted on autorickshaws in all towns.

- All Government schools educated children about cashless payment during morning prayers. Further, private schools were instructed to give homework about digital payment methods which had to be completed by students with the help of their parents.

- More than 1,90,000 digital transactions were facilitated by Saksham Yuva groups.

Training and Capacity Building:

Total 1,558 key employees were trained initially, who in turn, trained 8,000 employees of various departments. Training camps for traders, petrol pump owners, general public were held at Tehsil and Subdivision level. In addition, training was provided to rickshaw drivers and vegetable vendors.

Using Technology:

Social media platforms such as Facebook and Twitter were leveraged for promoting digital payments. Bulk SMS campaign was undertaken to generate awareness about digital payments. Video messages were broadcasted on cable TV channels and social media platforms.

Impact (01.04.2016 to 31.12.2017)

Sonipat has implemented 100% cashless enabled Subji Mandi. It also has the state’s first 100% cashless e-disha Kendra. Out of a total of 366 Fair Price Ration Shops (FPS), 350 are cashless enabled. Additionally, all 4 sub divisions, 6 Tehsils, 5 Municipal Offices are cashless enabled. Number of POS machine increased from 273 in November 2016 to 658 in November 2017.

Further, 81% of bank accounts were seeded with mobile and 82% of bank accounts were seeded with Aadhaar. Percentage of Electricity Bill payment through digital mode has increased from 4% to 88% in last 20 months.

Case Study 4: Bokara, Jharkhand

Implementing Digital Payments Promotion Strategies:

- The District Administration created a roadmap with the objective of increasing the digital literacy and digital payments in Bokaro.

- Informational advertisements were published in newspapers, and a large scale District-wide awareness camps and training programmes were conducted for all District level officers and staff. ‘BHIM Sena’ was created with a group of volunteers, Master Trainers to promote digital payments.

- The District officials conceptualised and implemented a Chai-Samosa training model and universal training programme of all Government school teachers.

- A two day workshop was conducted in the District to promote digital payments. Special camps were organised at every village and Block office. Door-to-door visits were undertaken by banking correspondents and team of volunteers. The ‘Cashless Walk’ was introduced in the District.

- Public awareness was targeted through social media including WhatsApp group for every block.

- As information can be disseminated faster and more efficiently through audio-video means, the Digi Rath or Digital LED vans were launched on designated route maps to enable adequate coverage across the District. The vans publicised details of digital payments, its benefits, ease of use, etc. Finally, financial literacy camps were also organised in all Panchayats.

Using Technology:

Public awareness was targeted through social media viz Twitter, Facebook and WhatsApp. Additionally, a WhatsApp control group was created for every Block in the District.

Monitoring Mechanism:

Weekly review meetings were conducted at District and Block level to monitor progress and identify and negate the gaps in implementation. Moreover, a control team was deployed at District and Block level to monitor awareness programmes conducted as part of the scheme.

Impact (01.04.2016 to 31.12.2017)

Payment to Pensioners was 100% done through digital medium and 100% labours payment under MNREGA was made digitally. Further, 100% Revenue Offices and 42 Fertiliser Shops have digital payment facility. Two cashless Panchayats at Dugda West and Dugda South and two Digi Gaon at Kura Village and Chandankiyari East were set up in the District, which were the first in Jharkhand. By the end of July 2017, all Government services in the District were provided to citizens where digital transactions were enabled.

Additionally, 69% of bank accounts were seeded with mobile phones and 81% of bank accounts were seeded with Aadhaar. The percentage of electricity bills paid through digital payment mode increased from 1% to 10% in last 20 months.

Case Study 5: Bhavnagar, Gujarat

Implementing Digital Payments Promotion Strategies:

A detailed action plan was developed by the District Administration for financial and digital inclusion for all departments. Training of all Police Personnel, District officers and Government school teachers was done. About 10 camps were organised for trainers and 65 camps at villages and 18 camps at schools and colleges. Additionally, a plan was prepared for Training of Trainers (T.O.T.s) as part of digital literacy training programme. 10 permanent training centres were set up in each municipality and all talukas to create awareness and 11 digital literacy centres were set up, where 100 ToTs and 52,000 were trained in the initial phase.

Further, two permanent digital and financial literacy centres were opened by banks where 36,602 people were trained. Digital literacy training for promoting digital payments was provided to all employees in the Government departments. Information, Education and Communication (IEC) activities were conducted using print, electronic media and social media, rallies, banners where in 14 lakh pamphlets were distributed. Three IEC vans were sent for awareness and converted digital literacy material in Gujarati. Special IEC van on wheels for scattered and industrial areas was deployed to educate illiterate people and labourers. Learning through sharing of experiences was promoted to increase transparency in the implementation of the programme.

Using Technology:

Suitable models and applications were developed for promoting digital payments. Hands-on training, use of audio-visuals and focus on learning by doing approach was established as part of this programme.

Monitoring Mechanism:

Daily reporting was done using Google Drive and WhatsApp for documentation, monitoring and planning by the District. Monthly review meetings were conducted and online data/work/progress reports were uploaded on the drive. A review meeting was held with bankers. In addition, coordination meetings were held and continuous monitoring and feedback exercises were done.

Impact (01.04.2016 to 31.12.2017)

A total of 3,618 PoS machines, BHIM and QR codes were installed. All 702 Fair Price Shops, 363 fertiliser centres, 10 Tehsil/Revenue offices, six Municipalities were digitally enabled. About 1,591 Integrated Child Development Services (ICDS) centres purchased fruits and other eatables with online payment only. All outsourced agencies/contractors received their payments digitally and all petrol pumps, gas agencies accepted digital payment. In the District, 88 villages were enabled with digital payment facilities. Total 4,11,848 RuPay cards and 3,76,008 Kisan Credit Cards were issued in the District.

As a case, Vallabhipur was a digitally payment enabled taluka where all 18638 families had bank accounts seeded with mobile and Aadhaar. All Gram Panchayats were connected with the internet. All Fair price Shops (FPS) and 27 milk co-operatives were digitally enabled and payment was made through banking channel. Further, 77% of bank accounts were seeded with mobile and 79% of bank accounts were seeded with Aadhaar. Percentage of electricity bill through digital payment mode increased from 4% to 6% in last 20 months.

Last Modified : 6/18/2021

This topic provides information about Block Task F...

This section briefs about various e-Governance ini...

The topic briefs about the e-Governance initiative...

This topic provides information about Ashraya - Pa...