Immediate Payment Service (IMPS)

Immediate Payment Service (IMPS)

IMPS is real-time remittance service available anytime, anywhere across India. Using IMPS customers can transfer money real-time to any person or to a merchant, for any personal or commercial purpose.

IMPS is available round-the-clock and operates even during bank holiday, weekends or festive holidays.IMPS can be used on any platform - Mobile, Internet and ATM across any bank in India. For any transfer, IMPS is the answer.

Benefits of IMPS

- Instant domestic fund transfer

- Available 365 X 24 X 7 (yes! we work on holidays too)

- Safe and secure

- Easily accessible

- Cost effective

- Available on Mobile, Internet and ATM

- Multiple transfer input options to choose from, for initiating transactions, such as IFSC / MMID/ Account no./AADHAAR no.

- Multiple access mechanism to choose from

How can you use IMPS?

You can use IMPS to transfer funds to your loved ones, pay merchants after shopping, pay bills and fees and pay for many more services listed below:

- Fund Transfer Services

- Merchant Payments

Fund Transfer Services

- Instant Account to Account Fund Transfer/Remittance

- Instant Account to Wallet and Vice versa

Funds can be transferred using any of the below options:

1. Using Mobile number & Mobile Money Identifier (MMID) of the recipient

IMPS offers instant, 24X7, interbank electronic fund transfer service from one person to other using mobile number and Mobile Money Identifier (MMID). Just ask the recipient to share the mobile number and MMID and transfer funds using Mobile phones or Internet or ATM.

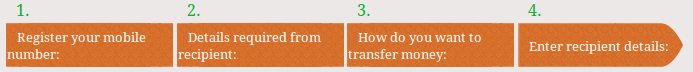

Simple steps to transfer funds using Mobile number & MMID

- Register your mobile number with your bank and ask for your MMID and M-Pin.

- Just ask for Mobile number & MMID

- Select a convenient channel to transfer money – Pick any one – Internet banking, mobile or ATM.

- Enter recipient’s mobile number, MMID and amount.

Banking Tip: MMID is a 7 digit number provided by your bank.

Safety Tip: You can keep an eye on your account by registering your mobile number.

2. Using Account number & IFS Code of the recipient

IMPS Person-to-Person (P2P) funds transfer can also be done using recipients account number and IFS code. Just ask the recipient to share the account number and IFS code (IFS code is available on the cheque book!) and transfer funds using Mobile phones or Internet or ATM.

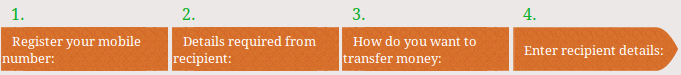

Steps to transfer funds using account number & IFSC

- Register your mobile number with your bank and ask for your M-Pin.

- Request recipient to share account number and IFSC

- Select a convenient channel to transfer money – Pick any one – Internet banking, mobile or ATM.

- Enter recipient’s account number, IFSC and amount.

Banking Tip: IFSC is a 11 digit alphanumeric number, available in the cheque book.

Safety Tip: Always remember your M-Pin, please do not write it anywhere or pass it to anyone.

3. Using Aadhaar number of the recipient

This is the simplest form of fund transfer, all you need is just the recipients AADHAAR number. Just ask the recipient to share the AADHAAR number and transfer funds using Mobile phones or Internet or ATM.

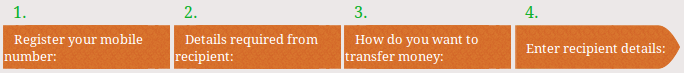

Steps to transfer funds using Aadhaar number

- Register your mobile number with your bank and ask for your M-Pin.

- Request recipient to share Aadhaar number

- Select a convenient channel to transfer money – Pick any one – Internet banking, mobile or ATM.

- Enter recipient’s Aadhaar number and amount.

Banking Tip: All transactions done using mobile will be authenticated using mobile number & MPIN.

Safety Tip: Never share your internet banking user id or passwords with anyone.

Merchant Payments

- Mobile top-up / DTH top-up

- Schools & Colleges Fee payments

- Utility Bill payments

- Online shopping

- Grocery Bills Payment

- Insurance premium payment

- Over-the-counter payments

- Fees payments to schools / colleges / universities

- Travel & Ticketing

- Credit Card Bill Payment

- Donation to religious institutes

Funds can be transferred using any of the below options:

1. Merchant payment using bank app

IMPS facilitates easy payments to merchants using bank app. It is instant, 24 X 7, available across banks. Make payments using Mobile phones (SMS and bank app).

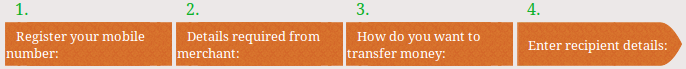

Steps to transfer funds using Mobile number & MMID

- Register your mobile number with your bank and ask for your M-Pin.

- Merchant's mobile number and MMID

- Select a convenient channel to transfer money – SMS or bank app

- Merchant's mobile number, MMID, amount and payment reference

2. Merchant Payments @ online website

Select IMPS as payment option when making payment on merchant’s website or mobile app. Make payments using Internet banking or through merchant app.

Steps to transfer funds using account number & IFSC

- Register your mobile number with your bank and ask for your M-Pin.

- Login to your bank app, choose IMPS option and generate OTP

- Enter your mobile number, MMID, amount and OTP

Banking Tip: One Time Password (OTP) is a six digit number & remains valid for one hour.

Safety Tip: Never share your ATM Pin with anyone.

The transaction types available in the multilingual languages are

- Balance Enquiry

- Mini Statement

- Fund transfer using account number using IFSC

Members are advised to promote the multilingual NUUP service amongst its users so that mobile banking can eventually reach to the last mile customers

NUUP Multi-Lingual Codes

| SR.NO | LANGUAGE | USSD CODE |

|---|---|---|

| 1 | Hindi | *99*22# |

| 2 | Tamil | *99*23# |

| 3 | Telugu | *99*24# |

| 4 | Malayalam | *99*25# |

| 5 | Kannada | *99*26# |

| 6 | Gujarati | *99*27# |

| 7 | Marathi | *99*28# |

| 8 | Bangla | *99*29# |

| 9 | Punjabi | *99*30# |

| 10 | Oriya | *99*32# |

Last Modified : 6/20/2024