Cross-border Payments

Cross-border Payments

Indo-Nepal Remittance Facilities Scheme

Based on the recommendations of the Committee on Modalities of Workers' Remittance between India and Nepal, the Indo-Nepal Remittance Facilities Scheme was launched in 2008 using NEFT. This cross-border remittance scheme provides a safe and cost-efficient avenue to migrant Nepalese workers in India to remit money back to their families in Nepal.

Nepalese citizens staying in India can avail of this service either as walk-in customers or as account holder and can remit up to ₹ 50,000 from any of the NEFT enabled bank branches in India. The money flows to a designated branch of SBI, which consolidates and transfers the amount to Nepal SBI Bank Ltd. (NSBL). NSBL disburses the remittance to beneficiaries in Nepal in the local currency either through the banking channel or a combination of banking channel and money transfer agencies in which payment is made to the beneficiaries against production of proof of identity as per KYC norms of Nepal.

Nepalese migrants are required to comply with KYC requirements at the time of sending the remittance. In case of remittance from bank account, no additional KYC is required. An originator in India is allowed to remit a maximum of 12 remittances in a year under the scheme. In case of return, transactions are transferred back by NSBL to SBI. Grievances (relating to non-credit or delay in credit to the beneficiary account or for complaints of any other nature) are addressed by the NEFT Customer Facilitation Centre (CFC) of the respective bank (the originating bank and / or SBI).

Money Transfer Service Scheme (MTSS)

Inward remittances into India are received through various channels such as banking, postal, MTSS and Rupee Drawing Arrangement (RDA). India is the largest recipient of remittances in the world with around 11-12% of global remittance inflows.

MTSS is a quick and easy way of transferring personal remittances from abroad to beneficiaries in India. The scheme allows remittance from abroad to Indian families and foreign tourists visiting India. A cap of USD 2,500 per transaction and up to 30 remittances in a calendar year has been placed for an individual beneficiary.

MTSS involves a tie-up between reputed money transfer companies abroad known as Overseas Principal and agents in India known as Indian Agents. The Indian Agents can further enter into sub-agency agreements with entities, for undertaking money transfer business. DPSS authorises and regulates the MTSS operators. As on date, authorisation has been granted to nine Overseas Principals under MTSS. Oversight of the Overseas Principal is done mainly through analysis of off-site returns submitted by them. Agents and Sub Agents of the scheme are regulated and supervised in the RBI by its Foreign Exchange Department.

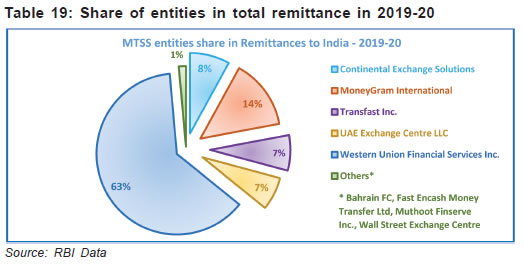

The overseas principal-wise share of remittances under MTSS in 2019-20 is depicted below.

Task Force on Cross-border Payments (TFCBP)

CPMI constituted a task force on cross-border payments in December 2019 and RBI is a member of the task force. In line with the G20 mandate to coordinate and develop a roadmap to enhance cross-border payments, the task force had undertaken a detailed assessment of existing cross-border payment arrangements and challenges.

The main objective of the task force is to evaluate concrete measures for improvement of the cross-border payment system, by combining greater efficiency with financial inclusion, while addressing associated risks. The task force evaluated

- areas for improvement of core payment infrastructures (including those provided by central banks),

- ways to foster interoperability,

- the role of innovative technologies, services and providers, and

- how payment system oversight and the role of central banks as a catalyst for change (e.g., by promoting adoption of international messaging / business standards) can support actions for improvement.

In the second stage of the project, the CPMI worked on these findings by creating building blocks of a response to improve the current global cross-border payment arrangements. RBI was involved in the following building blocks:

- Adoption of harmonised API protocols for payments data exchange, as the primary penholder;

- Actions for improved (direct) access to payment systems (including to RTGS), by banks, non-banks and payment infrastructures, as a peer reviewer and

- Reciprocal liquidity arrangements across central banks (liquidity bridges), as a peer reviewer.

The focus in the third stage was to build a clear work plan to deliver real improvements in cross-border payments. This roadmap was developed by the Financial Stability Board (FSB), in coordination with the CPMI and other relevant international organisations and standard-setting bodies. The roadmap identified specific actions under each of the building block identified in Phase 2 with established milestones and timelines. Further, authorities responsible for carrying out the actions were also identified. The roadmap provides a high-level plan, which sets ambitious goals and milestones, and is designed to allow for flexibility and adaptation, while ensuring that the safeguards in terms of secure processing and legal compliance are observed. It encompasses a variety of approaches and time horizons, in order to achieve practical improvements in the shorter term while acknowledging that other initiatives will need to be implemented over longer time periods.

RBI's PSS Vision 2019-21 envisaged enhancing global outreach of its payment systems, including remittance services, through active participation and co-operation in international and regional fora by collaborating and contributing to standard setting. RBI, in close collaboration with the Government and NPCI, is working in the direction of expanding the reach of UPI and RuPay globally. In this connection, it has written to other central banks highlighting the features of UPI as an efficient and secure system which can be used to transform retail payment mechanisms globally and at the same time promote financial inclusion. UPI system has the potential to evolve into a cheaper and quicker alternative to available channels of remittance for cross-border payments as well, whether related to retail remittances or small-value trade transactions. It could, in future, provide the basis for a stronger bilateral business and economic partnership with other jurisdictions.

The Reserve Bank has also participated in the regional outreach programs where the features of UPI and the possibility of leveraging on the UPI system to facilitate cross-border transactions was presented to participants. The Reserve Bank is collaborating with BIS to organise outreach events / webinars to spread awareness about the potential of UPI and encourage adoption of UPI / RuPay cards across jurisdictions.

Source : RBI

Last Modified : 9/17/2023

This topic provides information about Challenges i...