Electronic Payment and Receipts in Government

Electronic Payment and Receipts in Government

- Objectives of EPR framework

- Type of government payment and receipts

- Guidelines on Services with Payments from Citizens/ Businesses to Department (C2G and B2G)

- Categorization of Services offered by Departments on basis of IT readiness with respect to Payments Integration

- Guidelines for Services at various levels

- Guidelines for Payments from Government Department to Citizens/ Businesses (G2C and G2B)

- Guidelines for Payment/Receipts from Department to Other Departments (G2G)

- Guidelines for Payment from Department to Employees (G2E)

Ministry of Electronic and Information Technology (MeitY), Government of India envisages web-enabled /mobile enabled anytime, anywhere access to information and services across the country, especially in rural and remote parts of India. MeitY further envisages common e-Governance infrastructure that will offer end - to - end transactional experience for a citizen, businesses as well as internal government functions , which includes accessing various services through internet with payment gateway interface for online payments.

MeitY has hence prepared an Electronic Payment and Receipts framework, intended for State Governments, Govt. of India Autonomous Bodies, Central Public Sector Undertakings and Municipalities for expeditiously implementing appropriate mechanism to enable electronic payments and receipts.

Objectives of EPR framework

- Assess various services involving payments and receipts by types of services and level of electronic payment enablement

- Provide actionable instructions for universal adoption of electronic payment modes for each type of service through various payment channels

- Provide guidelines on engagement with various payment service providers

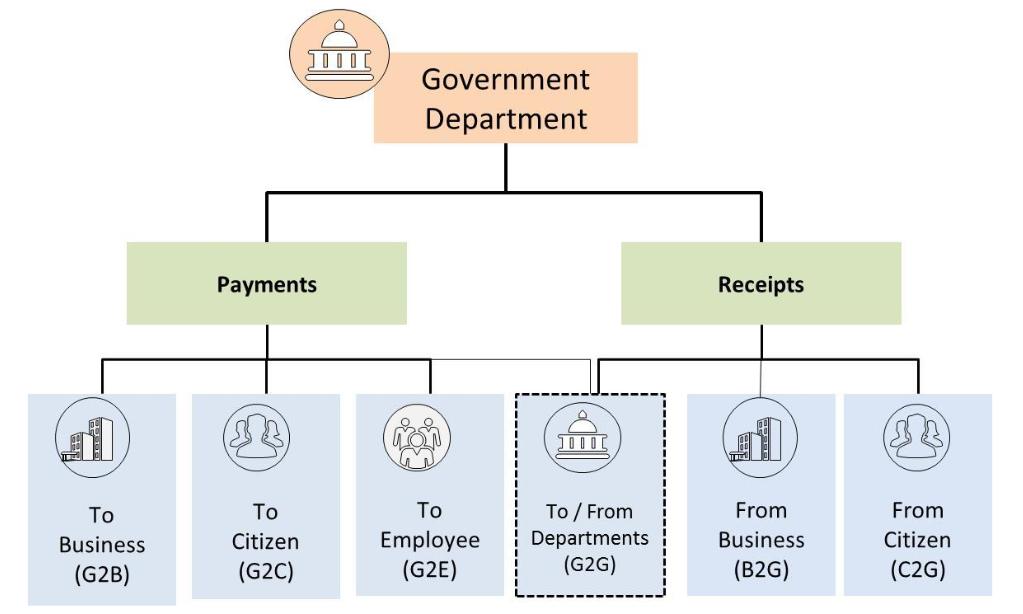

Type of government payment and receipts

The overall payments and receipts made by Departments can be categorized into seven parts.

Guidelines on Services with Payments from Citizens/ Businesses to Department (C2G and B2G)

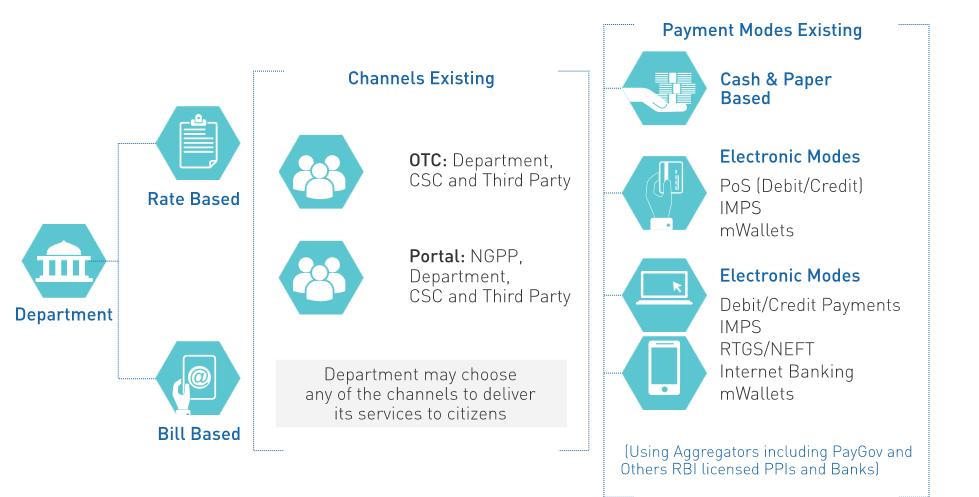

Categorization of Services offered by Departments on basis of IT readiness with respect to Payments Integration

The services delivered by Departments are categorized under the three progressive levels of IT as indicated below:

- LEVEL 1: Paper Based Records, Manual Billing System and No options for electronic payments.

- LEVEL 2: Electronic Records and IT Enabled processes with No Payments Integration

- LEVEL 3: Electronic Records Management, IT enabled and Electronic payments

Guidelines for Services at various levels

Guidelines for Level 1 Services

- Adoption of Payment Systems - Central / State Departments are advised to adopt systems for receiving payments electronically - State / State developed systems / Third Party systems / PayOnline.

- Adoption of Payment Channels - Central / State Departments are advised to also adopt multiple channels for receiving payments electronically.

- Adoption of Payment modes - For each of the counter based services through own counter/ Third party counters / CSC counters , department are advised to implement at least one of the following options of electronic payment modes at the counter : Debit /Credit Card or IMPS or PPI.

Guidelines for Level 2 Services

- Adoption of Payment Systems - Central / State Departments are advised to adopt Reserve Bank of India (RBI) approved Bank or Non-Bank Payment Service Providers including PayGov and others.

- Adoption of Payment Channels - Central / State Departments are advised to also adopt multiple channels for receiving payments electronically - online, mobile based, Government counter, Common Service Centres, etc.

- Adoption of Payment modes - Central / State Departments are advised to enable payment options through electronic modes : Debit /Credit Card or IMPS or PPI.

Guidelines for Level 3 Services

- Adoption of Payment Systems - Central / State Departments are advised to adopt Reserve Bank of India (RBI) approved Bank or Non-Bank Payment Service Providers including PayGov and others.

- Adoption of Payment Channels - Central / State Departments are advised to also adopt multiple channels for receiving payments electronically - online, mobile based, Government counter, Common Service Centres, etc.

- Adoption of Payment modes - Central / State Departments are advised to enable payment options through electronic modes : Debit /Credit Card or IMPS or PPI.

Guidelines for all levels - Payments to businesses for delivering government services to citizens (Indirect receipts to citizens)

Guidelines for Payments from Government Department to Citizens/ Businesses (G2C and G2B)

Govt. of India Autonomous Bodies and Central Public Sector Undertakings

- Departments are advised to adopt electronic systems for bill preparation, sanction payments and payment approvals and integrated with electronic payment processing systems for making payments to citizens and businesses

- Payments are advised to be made directly into beneficiary accounts except in exceptional cases, as envisaged by department/ organization specific guidelines

State Government Department, ministry, municipalities or Any other department receiving Government payments

- State departments are advised to use state payments systems developed and prescribed by State Government for bill preparation, sanction payments and payment approvals for making payments to citizens and businesses

- State Departments are advised to adopt electronic modes for payments to citizens/businesses

- Directly credited into citizen's/business's account

Guidelines for Payment/Receipts from Department to Other Departments (G2G)

Govt. of India Autonomous Bodies and Central Public Sector Undertakings

- Payments and Receipt to Other Government Departments : Organizations / departments are advised to process all payments to other government departments using electronic modes, with exceptions as stated by respective organizations.

- For receipts:

- Department may adopt PayOnline portal.

- For receipt of funds ( e.g. Un-utilized funds) from state governments, public sector entities or any other organizations/personnel, Government Departments are advised to provision following modes: RTGS/NEFT, mWallets, IMPS, Net banking

State Government Department, ministry, municipalities or Any other department receiving Government payments

- Department are advised to adopt any one or more options of electronic payments and receipts to Center, other State Government , public sector organizations and private entities :

- Department may adopt PayOnline portal.

- For receipt of funds ( e.g. Un-utilized funds) from state governments, public sector entities or any other organizations/personnel, Government Departments are advised to provision following modes: RTGS/NEFT, mWallets, IMPS, Net banking

- Accounting of G2G payments and receipts may be done through eTreasury system developed by NIC.

Guidelines for Payment from Department to Employees (G2E)

Govt. of India Autonomous Bodies and Central Public Sector Undertakings

- Payments to Employees : Organizations /Departments are advised to process all payments to employees including salary, LTA or any other compensation component using electronic modes only.

- Receipts from Employees: Department may adopt PayOnline portal or any other government / Autonomous body developed portal for receiving any deposits such as fines, unutilized grants /funds etc

State Government Department, ministry, municipalities or Any other department receiving Government payments

- Payment to Employees

- Advised to provision following modes: RTGS/NEFT, mWallets, IMPS, Net banking.

- Government Departments may also use either eSalary system developed by respective state's NIC Team or any state specific systems

- Receipts from Employees:

- Department may adopt PayOnline portal.

- For receipt of funds ( e.g. Un-utilized funds), Departments are advised to use electronic modes.

Source : NEGD

Last Modified : 6/28/2024