Access to Money

Access to Money

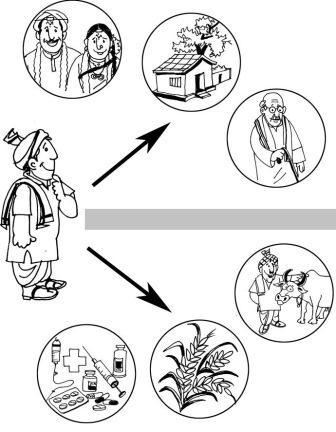

Sources of financing

Money lenders

Money lenders are a popular source of financing amongst people who are not used to dealing with banks and other formal lending institutions. They offer money on very flexible terms. For instance, some money lenders are flexible about the repayment terms. They will allow the borrower to pay in ad hoc or uneven instalments. Others will allow the borrower to carry forward the loan for long periods of time as long as an interest component is being paid. Many money lenders will not ask for any security backing (such as gold or land) upfront. Lastly, money lenders do not have a formal legal contract with the borrower.

Money lenders are a popular source of financing amongst people who are not used to dealing with banks and other formal lending institutions. They offer money on very flexible terms. For instance, some money lenders are flexible about the repayment terms. They will allow the borrower to pay in ad hoc or uneven instalments. Others will allow the borrower to carry forward the loan for long periods of time as long as an interest component is being paid. Many money lenders will not ask for any security backing (such as gold or land) upfront. Lastly, money lenders do not have a formal legal contract with the borrower.However, the drawbacks of borrowing from a money lender are more than the benefits. They charge a very high rate of interest compared to banks and other formal sources of money. There is no basis for the rate that they charge – it could be based on their needs rather than market trends. The penalties for not being able to pay back a money lender can be quite alarming. They can make demands which far outweigh the amount that has been lent. For instance, if a borrower is not able to pay back a few ten thousand rupees, the money lender may demand to have property worth lakhs transferred on his name. There have been a number of cases in which money lenders resort to illegal means of getting back their money, such as threats and violence.

Chit funds

The most basic form of chit fund involves a group of people who come together every month and contribute a certain amount of money. This amount remains the same from month to month. The names of all the members of this group are then written on chits of paper and put into a bowl. One name is drawn at random and the total contribution is handed over to the lucky individual whose name gets drawn.Every month, the name of the person who has received the fund in the previous month is deleted from the list. So each individual receives the fund only once. However, each member is expected to contribute every month, even after receiving the fund.

For instance, suppose there are 48 people in a group and each person has to contribute Rs. 1000 per month. Every month, one of these people will receive a sum of Rs. 48,000. However, that is exactly what they will have to pay to the chit fund over a period of four years.

These days, a more sophisticated version involves members of a chit fund bidding for the kitty through an auction process. The lowest bidder gets the amount which gets divided amongst all payees. This way, the amount to be paid every month keeps varying. The profit made is the difference between what you pay and the amount you get.

The benefit of a chit fund is the forced savings that it brings about. People keep contributing small fixed amounts every month which they do not really miss. Then once during the whole cycle, they receive all their contributions as a lump sum.

The drawback is that there is no guarantee that you will get your money, especially if your name is not one of the first few to be drawn from the bowl. There is no legal contract signed by all the members that binds them to contribute month after month. So, many chit funds dissolve after a number of people take their lump sum and stop contributing to the kitty.

Agricultural Credit Co-operatives

The major objective of agricultural credit co-operatives or credit service societies is to provide funding for various agriculture related activities. These include agricultural production, distribution, storage and marketing facilities. They also provide credit for purchase of light agricultural implements and machinery. Owing to an increasing emphasis on the development of land and agriculture, some agricultural co-operatives offer long-term credit or loans to farmers for purchase and maintenance of land. The Co-operative Movement was introduced by the Government of India to help farmers with their credit needs and give them a source of funding that would keep them away from money-lenders.Co-operative banks

Co-operative banks have been functioning in India for over a 100 years. These lending institutions provide credit to people in the rural areas at reasonable interest rates. They offer both short and long term loans for a variety of end users.These banks’ lending activities reduce the dependency of farmers on informal loan source and their unreasonable high rates of interest. Each co-operative bank usually has a typical culture (which comes from its place of origin) and gives preference to the credit needs of people from a particular region. As a result of these features, they do not seem as formal as national banks and people from the region are comfortable approaching them.

Co-operative Banks in India are privately run banks which are registered under the Co-operative Societies Act but the RBI also regulates them.

Micro finance

Micro finance is a concept that started in India in the early 1980s. It involves small self help groups (SHGs) and Non-Government Organisations (NGOs) coming together to provide credit and saving services to people who do not have access to the formal banking system. They undertake these activities more from the objective of bringing about development in areas which need it and less from any profit motive. These organisations are sometimes supported by large government bodies like Small Industries Development Bank of India (SIDBI) and the National Bank for Agriculture and Rural Development (NABARD). Sometimes they are also supported by large trusts set up specifically to make funds available to people at the lowest levels of society.These organisations are more likely to fund projects and give loans to people who cannot provide any security against the funding than even banks. They also charge little or no interest on the money that they lend. However, their criteria for lending may be limited. For instance, they may specify that they will lend only for activities related to farming, fishing or herding. Also, the maximum loan amount may not be very large.

Regional Rural Banks (RRBs) and Local Area Banks (LABs)

These banks are set up in the rural areas with the special purpose of funding agricultural and other activities in the rural areas. They give loans to small and marginal farmers, agricultural labourers and rural artisans.Their loans are structured to meet the needs of their customers and they charge rates of interest which are monitored by the Reserve Bank of India, our country’s central bank. While such banks do keep a small profit as a motive while giving loans, they aim to give out as many loans as possible to deserving borrowers, i.e. those who are likely to be able to repay. Some RRBs and LABs also help their customers to conduct studies on the best way to utilize the funds that they borrow so that both the bank and the borrower benefit.

Regional branches of large nationalised banks

Nationalised banks are fully supported by the government, and in fact, the government is a major stake holder in most of them. As a result, they keep in mind social responsibilities. Large nationalised banks like the State Bank of India, Bank of India, etc., have branches in the rural areas. These branches offer a variety of loans such as personal loans (which can be used for either productive or non-productive spending), auto loans, loans for small scale industries, loans for agricultural and allied activities, etc.The rates of interest on loans in the priority sector (certain activities defined by the RBI which banks must help) are relatively low.

Benefits and cautions while borrowing

- They would only have to pay interest if they do take a loan and more importantly, the rate of interest would be much cheaper than Moneylender charges.

- They can take loans for longer periods of time, if necessary, without worrying about having to be ashamed that they have not paid back sooner.

- Banks charge a very small penalty for paying back early as it upsets their plans for the total money that they manage. Yet in many cases it may still be beneficial for the borrower to pay back early and save money in terms of interest that would have to be paid if the loan was carried forward till its term.

- They would need to understand what the bank required as a security for the loan. banks offer a lower rate of interest on loans if borrowers temporarily transferred their assets, such as land papers or other investment, to the bank. Naturally, once the loan was paid off, the asset would be returned to the borrower.

Source: Portal Content Team

Last Modified : 2/12/2020

© C–DAC.All content appearing on the vikaspedia portal is through collaborative effort of vikaspedia and its partners.We encourage you to use and share the content in a respectful and fair manner. Please leave all source links intact and adhere to applicable copyright and intellectual property guidelines and laws.

RELATED ITEMS