Identifying and Prioritizing Needs and Goals

Identifying and Prioritizing Needs and Goals

The two families got together the next evening. After being served a wonderful dinner and kheer, Nazia took Nandan and little Kamini into the centre courtyard to play. Ammu and ammi sat down in the easy-chairs there and continued chatting. Kasim, Vignesh, Lata and Nasreen moved to Kasim’s study room to discuss financial planning.

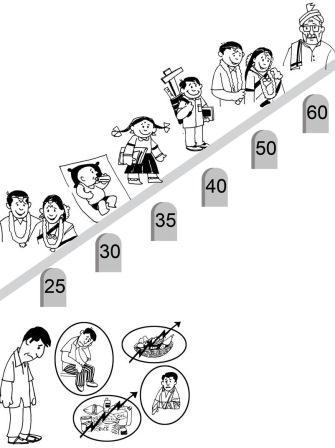

Hierarchy of Financial Goals

“So,” said Karim. “Where do we begin?”

“So,” said Karim. “Where do we begin?”

“That’s the problem that I always face,” replied Vignesh, half joking, half serious. “My finances are such a mess that I don’t know where to begin.”

“That’s not really true,” said Lata kindly. “He has saved up a good amount of money over the years. But he works such long hours that he finds it difficult to take time off to actually sit down and list out all the financial products that he has. And I have tried to do it for him but I can’t figure out exactly what he has collected over the years...”

“It can become a boring exercise if you let it...” says Karim. “The best way to begin is with your goals...We always enjoy discussing those.”

“Yes, it’s more like sharing our dreams for the future...then discussing how to fund our dreams become exciting...it’s like finding the shortest routes to reach our dreams,” joined in Nasreen.

“We do that too, but how do we make it a concrete exercise?” asked Vignesh.

“The first thing to do is to write down your goals. And make sure that you put them down in order of their importance. In fact you can separate them into necessary and desirable goals. For instance, you may know that saving for your retirement (necessary goal) is more important than taking a holiday this year (desirable goal) but because the retirement goal seems far away and larger, you spend on the holiday without setting aside what you should have for the retirement goal,” suggests Nasreen. “And one more thing, you have to have two lists...one of short term goals, priority-wise, one of long term goals, again priority-wise...”

“Then, once you have listed out your goals, you need to put a price tag to them, i.e. you need to decide how much money will be required to make them come true,” added Karim. “Once you have decided how much each goal will cost, you must match your existing investments to the goals which are high priority. In most cases, your investments are not likely to be enough to amount to the cost of all your high priority goals...so you’ll have to plan how you are going to save for them.”

Lata and Vignesh smiled at each other. Suddenly the task of reviewing their investments and planning for the future seemed like a challenging jig-saw puzzle.

“Karu, can you give me pen and paper,” said Vignesh. “Since Lata and I are all inspired right now, maybe we can list and prioritise our goals here and now. You two seem to be experts in this area and we could use your help...”

He drew a line through the middle of the page and wrote “Short term goals” at the top of the left column and “Long term goals” at the top of the right column. Then Lata and he began prioritising their goals. They had discussed their goals a million times over, like most couples do, but this was the first time they actually wrote them down...categorising them as short term and long term goals and in order of priority.

Here’s what the first draft of the list looked like:

| SHORT TERM GOALS | LONG TERM GOALS | ||||||

| Goal | By when | Cost | Financial products | Goal | By when | Cost | Financial products |

| NECESSARY GOALS | NECESSARY GOALS | ||||||

| Buy a two bedroom flat in the city | Within a year | Rs. 35 lakh | Money from sale of village house + sale of shares | Building a retirement corpus | 2040 | ? | PPF + Insurance company retirement plan |

| Paying Nandan’s annual fees | Next month | Rs. 34,000 | From fixed deposit of Rs. 50,000 maturing next month. | College fund for Nandan | 2025 | ? | Start investing in an insurance company child plan |

| Admission fees for Kamini | May, Next year | Rs. 65,000 | Money receivable from LIC Endowment plan | College fund for Kamini | 2030 | ? | Start investing in an insurance company child plan |

| Marriage expenses for the kids | 2035 | ? | Mutual fund investments in schemes | ||||

| DESIRABLE GOALS | DESIRABLE GOALS | ||||||

| Holiday in Simla- Manali next May | ? | ? | ? | Purchase a second house for investment purposes | ? | ? | ? |

| Gift Lata a 20 gram gold chain this Diwali | ? | ? | ? | ||||

Now that they had started, they decided that they would keep adding to the list over the next week. They also decided that as soon as they went back to the city, they would complete the exercise by filling in all the columns on this page.

- They would have to list out all the goals they could think of in as much detail as possible.

- They would have to decide by when they would ideally like to achieve the goal.

- They would have to put a cost to each goal. It is easier to put a cost to a short term goal...all they have to do is find out the current price. For the long term goals, they would have to find out the current price and increase it by a certain per cent for every year until the goal is ready for achievement. For instance, if a post graduate education costs Rs. 4 lakh today, by the time Nandan is ready to enter the course, say 15 years from now, it will cost approximately Rs. 8,31,500. This is based on an assumption that the cost of education will increase at the rate of 5% every year. If you have trouble guessing how the cost of any goal will increase over time, use the average inflation rate for the past few years as an average rate of increase for all future goals...and hope prices do not increase by more than that!

- Lastly, and most importantly, they will have to gather all their current investments and see which ones match the goal in terms of maturity and amount. This is because they have invested without any planning so far. Ideally, and from now on, they will look at this list of goals and choose investment products. Each product will have the same tenure as a goal. By the time that goal is ready for fulfilment, the amount that the financial product will return will be equal to their expected cost. Of course, it is not necessary for them to choose one investment product per goal...they may use a combination of products for each goal or each set of goals.

“We are really so thankful to you for helping us with our financial planning exercise...”said Vignesh.

“But your financial planning exercise has only begun. You have not taken into account planning for emergencies. That is a very important part of financial planning...” replied Karim. “It is late now and the kids must be tired. Perhaps we can meet again tomorrow evening at the park near the high-street and carry on this discussion.”

“Oh that would be really nice,” replied Lata. “We are looking forward to it.”

Expected and Unexpected Events

“Life is full of surprises,” began Karim, watching the children playing with a ball. The two couples had settled down on the grass with a large packet of roasted nuts and gram between them. “While we enjoy the good surprises that life throws at us, we must be prepared for the bad ones. If we do not, it can spoil our entire financial planning exercise.”

“Tell them the story that Paresh chacha told us the other day...” suggested Nasreen .

“Yes...that would bring out the importance of planning for emergencies...”replied Karim. “It was a story of a young couple - Dinesh and Meera who lived alone in a small city, away from their hometown. Dinesh worked in a mid-sized company as an accountant and Meera was a housewife. They had no children.

Dinesh’s parents lived in their ancestral house in their hometown. His father was a retired government officer. They had always lived a humble life. They never had any serious financial problems and always lived comfortably but they never owned their own vehicle or went on expensive holidays or spent on grand celebrations.

Their 25th wedding anniversary was fast approaching. Dinesh and Meera wanted to surprise them by gifting them a Nano car. The young couple were well aware of the process of financial planning and how it could take them closer to their goals. As a result, they had been saving up for the past 3 years and investing regularly in a recurring deposit. The deposit would mature about 6 months before Dinesh’s parent’s anniversary and give them a total amount of Rs. 1.5 lakh.

All of a sudden, they received a call from Dinesh’s mother telling them that papa had a stroke and although he seems fine, he had been advised to do an angiography – a test to check whether he had any blocked arteries. Dinesh and Meera insisted that the parents should come to stay with them in the city and get the test done there. It turned out that Dinesh’s father did have a block and the doctor performed a successful angioplasty (procedure to remove the block) on him.

Dinesh’s father had health insurance. However, it was not enough to cover the cost of the treatment in the city. Dinesh paid the balance amount of the treatment from the money he had saved up to buy his parents the car. Meera and he decided that they were lucky that they had saved up enough to pay for the treatment or else, perhaps, they may have had to take a loan. They also assured each other that they would start saving again and buy that car for their parents a couple of years later.”

Karim concluded, “The lessons from this little story are:

Financial planning does not need to be discarded in an emergency; it must be carefully altered to suit the situation. Later it can be set back on track for the same goals.

Always set aside some money for emergencies; one can never tell when they will pop up. The best way to plan for emergencies is to ensure that the family has adequate health insurance and the main earning member has enough life insurance.”

“He’s right,” agreed Lata. “Amma is unwell and besides anything could happen to any of us. We must set aside money for emergencies too.”

“In fact, we will review the amount of pure term insurance and health insurance we have as soon as we go home ...” said Vignesh

Source: Portal Content Team

Last Modified : 2/21/2020