Review and Revising a financial plan

Review and Revising a financial plan

- You have another child

- You get a job that pays you much more than you were earning before

- You get an offer to go abroad

- Your wife takes up a hobby and then makes it into a profession that pays her very well

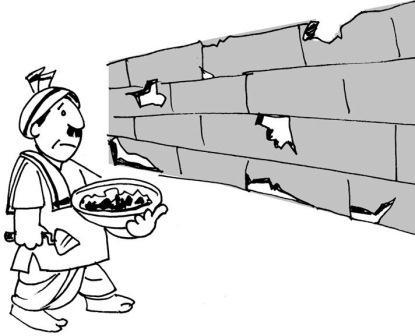

There are many other happy events in life that affect your financial plans and require you to modify them. Following a financial plan should be like maintaining your house...don’t wait till you have to undertake large scale repairs, keep making small modifications from time to time so that it is always in good shape.

Review of a financial plan

Changing your financial plan too often will be as bad as not having a financial plan at all. Then again, there is no ideal fixed period after which reviewing a plan can be recommended. It is up to you to decide on how often to review the plan – every six months or every year or every 2 years or every 5 years.

The factors that will guide you regarding how often you should review your plan are

- Financial products - The type of financial products that you have invested in. If there are products that are maturing at short intervals, you may have to review your plan more often.

- Goals - The types of goals that you have set. If you have many short term goals, as each goal is achieved, you need to review your financial plan.

- Personal factors – If the number or your dependents increases or decreases, you need to review your plan. If your income increases or decreases, you need to review your plan...and so on.

Reviewing your financial plan involves

- Deciding if all the goals that you have set are still relevant –

- Deciding if the time frames that you set for the goals are still the same as you had previously decided – Will your child still be getting married at the age of around 25, as you had planned or does it look like she may marry earlier or later.

- Are the financial instruments that you chose to meet your goals going as per plan? This is more the case for investments in unpredictable investments like shares or equity mutual funds. In the case of fixed income investments, you know for how long you are investing and what you will get. But in the case of shares, you may have expected them to do well and they don’t or they may out-perform your expectations. You need to see how these instruments are functioning as per your expectations.

Reconstructing the plan

The whole idea of reviewing your financial plan is to reconstruct it, if necessary. If you are not comfortable with your financial situation after review and you feel your financial plan is not taking you closer towards your goals...you need to modify it. Modifying the plan involves:

- Deleting goals that you have already achieved or do not wish to achieve anymore from your plan. It also involves adding fresh goals to it.

- Changing the time frames that you set for the goals, if necessary. Coming back to our example: If your child is planning to get married next year instead of 4 years from now, you will have to rearrange your finances to arrange for the amount that you originally planned to collect. Alternatively, if nothing else is possible, you may have to lower the amount that you had originally planned to spend on the wedding.

- Investing and disinvesting in financial instruments if necessary. Suppose you have planned to retire at the age of 60 years. As per your financial plan, you had been investing in stocks and you had decided to gradually take money out of the stock market from the age of 55 years onwards and put it in fixed income instruments. This was just to ensure that your money would be safe there. If you have reached the age of 53 years and are very convinced that the stock markets are going to be down for the next 5 years, you may start disinvesting from stocks right away. You may also feel that since interest rates are high at present, you can shift a bulk of the money that you have collected in shares into fixed deposits to benefit from safety and high interest income.

Restructuring your financial plan is a crucial exercise. However, it should be undertaken only if the financial plan absolutely needs to be restructured. Unnecessary interference with the financial plan will spoil any long term results that a financial plan can deliver.

Source: Portal Content Team

Last Modified : 2/23/2020