Home insurance

Home insurance

Saving Energy, Saving money

Rajendra and Leela decide to list out their expenses for a couple of months. After three months, they find that most other expenses can be lowered, if required. However, their electricity bill is consistently high. To add to it, there are times when the couple forget to pay the bill – as they are still getting used to managing a home on their own. This leads to late payment charges on the bill amount.

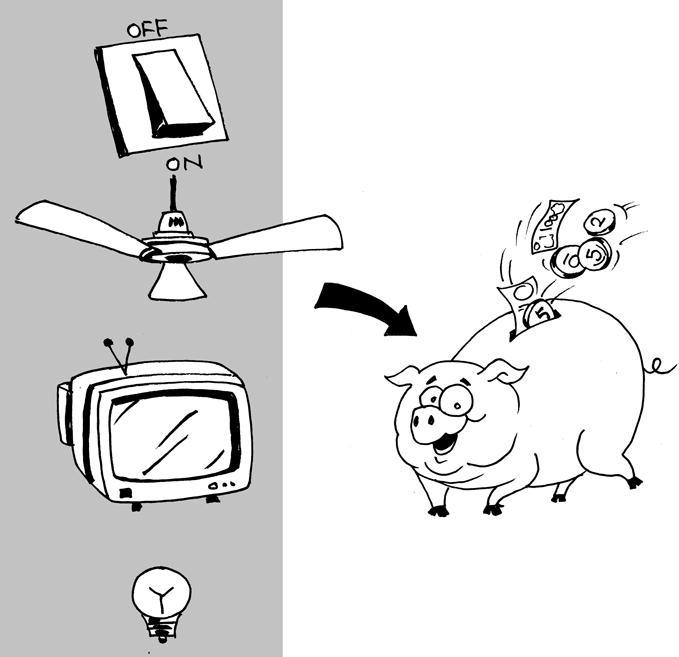

They decide to take three measures to ensure that their electricity bill amount comes down:

- They plan to put up a solar panel on their terrace. Their neighbours have put up such panels and are able to heat water and run other small electronic devices from the energy that they receive from the panels. They also hear that there are government loans at very low rates of interest available for this purpose. They contact their neighbours who have already put up solar panels to find out the cost and application process for putting up these panels. With this one-time expense, they can be assured of lower electricity bills for life.

- They decide that whenever possible, they will switch off the lights, fans and other electrical appliances – Leela decides to sit on the large swing under the mango tree in their courtyard when she has to cut vegetables or clean the grains. This way she will enjoy natural sunlight and breeze and save electricity too. They also make a comfortable sitting arrangement in the courtyard so that they can entertain their relatives and friends there. This will result in lower consumption of electricity.

- Lastly, they decide to pay their bills on time. To ensure this, they make a large mark on the calendar that hangs in the kitchen – before the date on which the electricity bill payment is due. Rajendra’s brother Darshan has a mobile phone on which reminders can be set. Since Rajendra meets Darshan daily at the shop, he requests Darshan to set a reminder on the mobile phone and in turn, remind him to pay his bill.

Home owners insurance

One afternoon, Rajendra’s friend Prakash, who is an insurance agent, comes to the shop to purchase groceries.

One afternoon, Rajendra’s friend Prakash, who is an insurance agent, comes to the shop to purchase groceries.

“Raju, I hear that you have shifted to your own house...” he says.

“Yes, you must come and see it,” replies Rajendra.

“I certainly will. Don’t mind me asking...have you insured your home?” asked Prakash.

“No we haven’t,” replies Rajendra. “We never considered insuring our home...in fact, I have heard about home insurance but I do not know exactly what it is and how it works.”

Rajendra realises that since he has been given a home of his own, he will have to give up any stake that he may have had in his ancestral home. The new home will be the only asset that he and his wife own, in addition to Leela’s jewellery.

Naturally, they would want to protect this house in every way possible as it means so much to them, both financially and emotionally. They had heard about the possibility of insuring the house and were eager to understand how they could safeguard it with this financial product. Prakash’s visit to the shop seemed so fortunate...

“If you have some time to spare, I could tell you about home insurance right now...” suggested Prakash.

The shop has relatively few customers in the afternoon. So, Rajendra orders two glasses of special tea from the tea stall outside the shop and the two friends sit down to discuss home insurance.

Here is what Rajendra finds out after a long chat with Prakash.

What is home insurance?

In most cases, home insurance offers the option to safeguard both the home structure and expensive items contained in the house as well. As in the case of any insurance policy, all you have to do is pay a small amount (called premium) at regular interval (annually, quarterly or monthly) during the term of your policy. Then, in case any of the events covered by the policy take place during the policy and you face damage or loss to your home or property, you can file a claim.

What does home insurance cover?

We can claim home insurance in a variety of cases such as destruction of house structure or property due to fire, lightning, explosions, riots, terrorists, bursting and overflowing of water tanks or pipes, leakages from automatic sprinklers installations, storms, cyclones, hurricanes, floods, earthquakes, volcanoes, etc. It also covers damage done by rail/road vehicles and animals, landslide, including rockslide, missile testing operations and more. Some home insurance policies also cover losses due to burglary and some cover jewellery kept in locked safes within the home premises.

How are claims valued?

The amount that we receive for damage done to the house and the items inside is usually based on its Reinstatement Value. This simply means that we receive the amount of money that it will take to reconstruct the house or replace the items in the event of any loss or damage due to any of the events named above.

What should we do if we want to file a claim?

If you wish to put in a claim for any loss or damage that has been done to your home or property, all you have to do is call the insurance company to register your claim. You must do this as soon as possible. You can give them the details of the damaged equipment or the location of the loss. Also tell them about the probable cause of loss and approximate amount of loss. The most important thing is you have to tell them your policy number so that they can start the claim procedure.

Once you register a claim, a surveyor (a person who will check what damage has actually been done or the site of the loss/theft) will come to estimate the loss/ damage.

Then, once the company is convinced about your loss or the damage to your property (as the surveyor confirms) and they receive all the required documents (FIRs filed with the police and police report, fire brigade report, repair bills as per their surveyor, purchase bills for items stolen or lost, etc) your claim will be paid out to you.

Source: Portal Content Team

Last Modified : 2/21/2020